Flawed paper behind covid-19 testing faces being retracted, after scientists expose its ten fatal problems

Содержание:

- Buy Clothes, Footwear & Fashion Online for Women, Men & Kids | Reliance Trends

- Working from home

- Fast-forward trend 2: Declining global exposure

- Data on Ecommerce & Coronavirus’ (COVID-19) Effects

- Taking the government to court

- The trend: Cross-network opportunities grow as Google search traffic falls

- Conclusion

- Fast-forward trend 5: Private and social sectors step up

- We expect the impact of the crisis on consumer behavior to create or accelerate five trends in the retail sector that will have lasting impact.

- Understanding Panic Buying and Coronavirus

- Fast-forward trend 3: Rising competitive intensity

- Next steps for retailers

- Emergency Department Visits

Buy Clothes, Footwear & Fashion Online for Women, Men & Kids | Reliance Trends

About Reliance Trends

Reliance Trends is a leading omnichannel lifestyle retail chain with over 800 retail stores across India. Reliance Trends offers stylish, high-quality products across Womenswear, Menswear, Kidswear and fashion accessories through a diversified portfolio of own brands, national and international brands. Trends Footwear stores specialize in offering high quality footwear & accessories for the modern Gen-z shoppers.

E-commerce Offerings from Reliance

Aspiring to provide utmost convenience to the modern Indian shoppers, Reliance Trends has also opened an online e-commerce store, accessible 24×7 at https://www.trends.ajio.com/. Reliance Trends offers an unparalleled collection of products at jaw-dropping prices with customer friendly features like doorstep delivery, Cash on delivery, easy returns & exchanges, doorstep refunds, etc.

International Brands on Reliance Trends Online Store

Reliance Retail has a portfolio of over 45 international brands that spans across the entire spectrum of luxury, bridge to luxury, high–premium and high–street lifestyle. Reliance Retail operates over 682 stores for these international brands and continues to partner with new and revered international brands. The strong brand portfolio reinforces Reliance Retail as a partner of choice for best international brands like Steve Madden, Armani Exchange, GAS, Superdry, Scotch & Soda just to name a few. The entire merchandise is also available to buy online at https://www.trends.ajio.com & https://www.ajio.com/

In-house Brands on Reliance Trends Online Store

Building on it’s capability of fabric manufacturing & deep understanding of the tastes & preferences of Indian shoppers, Reliance Trends has also introduced some of the best quality fashion brands in their offline & online stores.

Women can buy products online from top brands like Avaasa for indian wear, Fusion for indo-western wear, Hushh for innerwear, etc. Men can buy products online from popular brands like Network for formal wear, Netplay for casual wear, Pureza for high quality cotton/linen shirts, Graviti for inner wear, etc.

Youth is the powerhouse of our country & Reliance Trends has many brands for the youth like — DNMX for T-Shirts & Denims, Performax for sports & active wear, Rio for snazzy trends for young women, fig for the modern independent working women, etc. It also houses brands for kids like Point Cove, Frendz, etc.

Working from home

Whether following government advice, or using their own discretion, companies have had to close to protect both staff and customers. But were we ready?

With 330,000 mentions of workplace closures throughout March, the issue became a major talking point when it peaked on March 16. This was led across the country.

Mentions of workplace closures peaked on March 16, with many brands independently deciding to close stores to protect staff and consumers. Sample: 2%

From then on, people had to switch to working from home, where possible. And it seems people were ready. Just. Although the peak came after businesses started closing, there was a large uptick of working from home conversations, demonstrating an awareness that processes would have to adapt before they were needed. A little preparation goes a long way.

Mentions of working from home, started peaking from March 13, demonstrating some mild preparation for the closures ahead. Sample: 2%

When we consider the usual chatter regarding working from home is around 50,000 mentions per week globally, 2.84million mentions from the peak week of the crisis, demonstrates a significant change in consumer habits.

What conversations are driving the trend?

23.1% of working from home conversations are driven by technology and related matters. The displacement of significant parts of the workforce, has required a significant technological input.

Technology (23.1%)

Conversations around technology, fall into 3 main categories —

- The new tech needed to keep working.

- The tech needed to keep in touch.

- Cybersecurity.

Brands have had to invest heavily in updating their processes and workflows, to ensure collaboration can continue from afar. Cybersecurity is a major part of this, providing people with the tools they need, while protecting confidential company data.

Brands should be tackling cybersecurity risks, to protect both the company and their customers.

Home working tips (22.9%)

With working from home only becoming big in the last 2 weeks of March, people are still adjusting. Unsurprisingly then, the conversation is being led by hints and tips about how to handle it.

Sharing great working from home tips, can help build community engagement, and provide consumers with much needed help in a difficult time.

Other major conversations

Working from home struggles (10.9%) — From the serious, to the silly, people are listing the issues they’re facing in this new environment.

Confinement is certainly a real issue now.

Entertainment (6.7%)

After a long day at work (at home), people are craving more entertainment. Including more traditional and nostalgic crafts.

Now is a great time to engage new followers with hands-on activities.

Pets (3.3%)

Of course, if you’re at home all day, then that means more time with your pets. And there’s nothing more exciting on the internet, than pictures of people’s cats or pupers.

Dogs and cats drive excellent engagement even at the best of times. Right now, they’re just the pick-me up people need.

Working from home — brands

The leading tech brands that help people keep in touch are dominating all work from home conversations. Video conferencing tool, Zoom, is mentioned in 0.83% of all working from home conversations, showing a huge uptake of the tool over the last month.

Similar collaboration or efficiency tools such as Skype, Microsoft Office, Google Hangouts, also dominated the topic.

Fast-forward trend 2: Declining global exposure

A mix of geopolitical and economic forces was already driving a change in the relationship between China and the world, and COVID-19 appears to be accelerating this trend.

Before COVID-19, China had been reducing its relative exposure to the world as the majority of economic growth was generated by domestic consumption, supply chains matured and localized, and its innovation capabilities were enhanced. The US–China trade dispute raised risks and uncertainties, and about 30 to 50 percent of companies surveyed by various institutions in 2019 indicated that they were considering adjusting their supply-chain strategies by seeking alternative sources or relocating production to other geographies. COVID-19 has intensified the debate, with several governments calling for companies in critical sectors to relocate their operations back to their home countries and announcing financial support packages to facilitate this. Twenty percent of companies surveyed by AmCham China believe COVID-19 may accelerate “decoupling.” A paper published in February by the European Union Chamber of Commerce highlighted how diversification is now at the top of the agenda for many European companies in China. Global trade and investment has slowed sharply, and the movement of people has become highly restricted.

Despite these trends, the full picture is more nuanced. Given the size and the growth potential of the Chinese market, investing in a supply chain and innovation footprint to serve China will continue to remain important. And China for its part will continue to require global technology inputs in order to maintain productivity growth. The relationship between China and the world will be a function of the decisions that all parties make over the course of the next several months and years.

As an index, we’ve compiled data from ~$190M in ad spend from ecommerce brands at a minimum of $60k per year. All metrics have been standardized to one-day attribution.

For the last 28 days (year-over-year) …

- Spend: +56.20%

- Revenue: +47.23%

- CPMs: +20.38%

- ROAS: -5.72%

- Conversion rates: +109.93%

Below is each metric’s daily average:

Categorical data merged from a host of sources shows both disparities as well as one overarching refrain …

Whether temporary gold rush or enduring step change, now is an unprecedented moment. Now is ecommerce’s time to act.

For a full list of sources and links, see the at the bottom of this article

- Spend: +246.09%%

- Revenue: +247.04%

- CPM: -0.04%

- ROAS: +0.28%

Widening the scope from paid media to ecommerce at large, data from the US Census Bureau puts online’s share of retail for Q2 at 16.1% — up from 11.8% in Q1 and 11.3% in Q4 2019.

An increase of 4.8 percentage points for the first half of 2020 compared to 4.5 for the five previous years.

Moreover, while US ecommerce saw an average quarterly increase of 14.9% throughout 2019 (compared to 2018), Q2 2020’s increase was a staggering 44.5% YoY.

Perhaps most striking, ecommerce’s 16.1% US market share jumps to 26.4% when only “core retail” categories are taken into consideration.

Data via US Census Bureau, FRED (ECOMPCTSA) & Retail Geek

Taking the government to court

It is clear that the wars over PCR tests are hotting up, and the stakes couldn’t be higher. A new organisation in the UK, calling itself PCR Claims, has been set up to challenge in the courts the British government’s handling of PCR testing for Covid-19.

The organisation describes itself as a pro bono network of lawyers, life scientists, and business advisers led by Jo Rogers, a lawyer who runs Navistar Legal.

Rogers told RT.com: “The intention is to expose the controversy of the inappropriate use of PCR in the context of pillar 2 community testing and private sector lighthouse labs.

“PCR was not designed for mass testing because of the sensitivity and risk of contamination. There are serious flaws in many of the protocols employed, which were hurriedly put together, some without peer review. The operational false positive rate is unknown and therefore every positive test could be false, unless accompanied by clinical examination.”

As an example of errors with PCR, the group points to a recent case from Cambridge University. “Our first priority is to gather evidence of the harms from restrictions to life whose policies were driven by PCR test modelling and/or ‘case’ results,” Rogers said. “We believe the cases are a pseudo epidemic, as seen in other places around the world using PCR testing.

Also on rt.com

A global team of experts has found 10 FATAL FLAWS in the main test for Covid and is demanding it’s urgently axed. As they should

“Legal action is progressing and further instances will follow as we receive the evidence of harms. The gathering of that evidence is ongoing nationwide, as well as our raising awareness of errors and negligence.»

As someone who shares their deep concerns over these PCR tests, this is good news. At last, there is somewhere to go for expert legal counsel on the government’s persecution of free-born citizens. And thank heavens also for the stellar work of the entire peer review team for holding this bad science to account. If indeed it is retracted, it will be a major victory for those of us who can see through what Dr Mike Yeadon, one of the paper’s debunkers, rightly calls a “false positive pseudo-epidemic.”

Like this story? Share it with a friend!

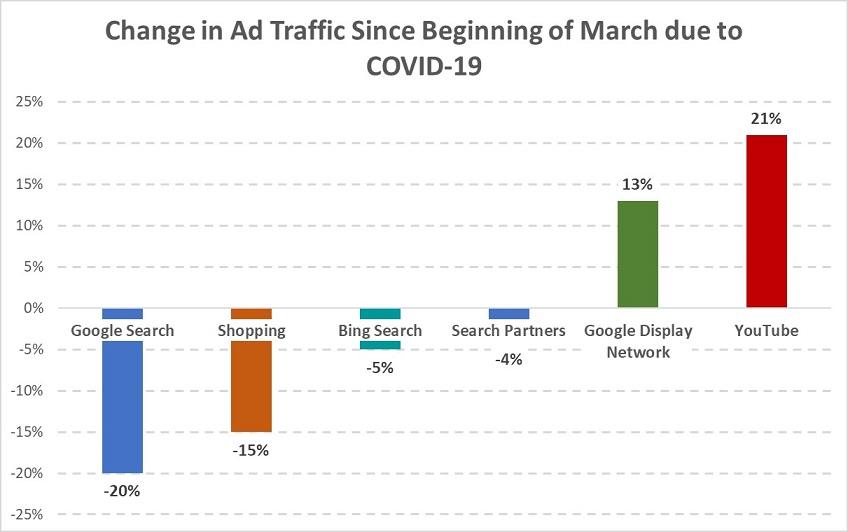

The trend: Cross-network opportunities grow as Google search traffic falls

While people may be spending less time out in brick and mortars and less time on Google search, our internet use is up nearly 50% since COVID-19 became a pandemic. The good news is that you can still reach your prospective customers online—they’re just looking in different places.

Since the beginning of March, Google search and Google Shopping may have taken considerable dives, but there’s still plenty of opportunity out there. Bing Search and Google search partners have remained relatively safe and steady places to find your customers and usually have cheaper CPCs than Google search.

On the other hand, finding your customers off the SERP is becoming increasingly easier! This past week, traffic from the Google Display Network grew 13% since the beginning of the month. And YouTube views are soaring—up 21%! For tips on display advertising during COVID-19, head here.

How to respond: Reach your audience on other networks

1. Now more than ever it’s crucial to advertise across networks

We’re all in for a rollercoaster of a ride on the Google SERP over the next few months as behaviors change. With Google search currently beginning to fall, you’ll have to find other networks to help make up some of that loss. Advertising across multiple networks will help mitigate the volatility of just relying on Google search alone. Additionally, we see that by advertising across networks other than Google search, you’ll find new audiences and even increase the number of people who later search for you on Google.

2. Include Google search partners in your campaigns

Google search partners include many smaller search engines that are powered by Google, like ask.com and countless smaller local search engines. While many may prefer the Google brand of search, the truth is that not every search occurs on Google.com. These partner search engines make up about 10% of Google’s search reach, so consider including them to your campaigns to make up some of the lost search traffic you’re experiencing due to COVID-19.

To include search partners in your campaigns, simply check the “Include Google search partners” box within the networks tab of your campaign settings. To view your ads performance on these search partners, you can segment your data by “Network (with search partners.)”

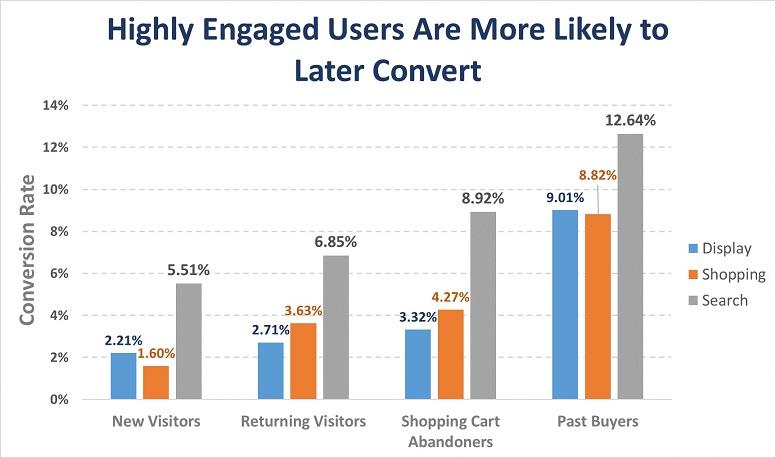

3. Dive into display and YouTube

With so much of your audience spending more time online, now it’s easier than ever to find them while they browse the web, scroll their social feeds, and watch videos online. Consider starting off by remarketing to your past customers and website visitors to bring them back to your site and keep your brand in their mind. When they return to your site, they’re often much more likely to ultimately convert on their return visits!

It’s unfortunately clear that the coronavirus is going to change our daily lives for the next few months at least. Stay safe and healthy, and practice social distancing. While you’re stuck inside, keep an eye on your PPC accounts and the WordStream blog. We’ll be posting regularly with new data and strategies to best adjust your campaigns in these rapidly changing times.

This report is based on a sample of 15,759 US-based WordStream client accounts in all verticals who were advertising on Google search, display, and YouTube throughout March 2020.

Conclusion

We are, all of us, currently living in flux.

Your customers are trying their best to adapt to strange times without a lot of footholds and shifting their behavior as a result. As a business owner, you are facing much of the same uncertainty, while trying to support your customers’ needs and your own.

Depending on your industry and audience, your response to the ever-evolving situation will change. You know your customers better than anyone. We hope this resource has helped you understand some of the ways their behaviors are changing, so you can continue to serve them as best you can.

Want more insights like this?

We’re on a mission to provide businesses like yours marketing and sales tips, tricks and industry leading knowledge to build the next house-hold name brand. Don’t miss a post. Sign up for our weekly newsletter.

During the 2003 SARS outbreak, the government and state-owned enterprises (SOEs) were the primary actors during the economic recovery. Now, the private sector and leading technology companies are playing a more significant role, making large socioeconomic contributions amid the emergence of powerful social institutions that have donated millions to recovery efforts. Policy debates also indicate COVID-19 might be accelerating long-awaited structural reforms to land, labor, and capital markets.

In the wake of the 2003 SARS outbreak, SOEs were the major driver of China’s economy, accounting for about 55 percent of China’s assets, and 45 percent of profits. Today, the private sector contributes close to two-thirds of China’s economic growth, and 90 percent of new jobs, illustrating a significant shift in the balance of economic power. In the wake of COVID-19, joint efforts between government and large private companies have played a leading role. For example, Alipay and WeChat supported the Shanghai government’s “Suishenma” health QR code launch to help contain the spread of the virus.

These actions illustrate the growth of the private sector, its ability to participate in activities of national importance, and the potential of public–private partnerships. Meanwhile, social institutions including the Bill & Melinda Gates Foundation and the Vanke Foundation have donated millions of dollars to aid recovery efforts. We expect social institutions like these to play a vital role in shaping Chinese society going forward.

In the rest of this report, we explore in more depth how five key trends that have been shaping the Chinese economy have been accelerated by the onset of the COVID-19 crisis.

Download Fast forward China: How COVID-19 is accelerating 5 key trends shaping the Chinese economy, the full report on which this article is based (PDF–844KB).

Interview

We expect the impact of the crisis on consumer behavior to create or accelerate five trends in the retail sector that will have lasting impact.

Shift to online and digital purchasing. As shelter-in-place orders proliferate and potentially extend, and consumer anxiety about infection persists, consumers across age groups have already shifted spend to online channels. The longer the crisis lasts, the greater the likelihood that online and omnichannel purchasing will become the next normal. While this shift is pronounced in grocery and other essential categories, the channel shift within apparel, fashion, and luxury (AF&L) brands and retailers has not come close to making up for the lost brick-and-mortar sales as our recent article on the impact of COVID-19 on the sector demonstrates.

Across both AF&L and food, drug, and mass-merchandise (FD&M) players, the shift in consumer spending to online will pose a question about the future—and purpose—of their brick-and-mortar locations. Driving unique in-store experiences will become even more critical than it has been to drive traffic, facilitate the omni-experience, and improve profitability.

Healthy, safe, and local. One of the biggest challenges facing retailers is the need to protect customers and employees from contracting or spreading COVID-19. Concerns about health and safety have never loomed larger for stakeholders across the value chain. The retailers with the highest degree of touchless automation, both in stores and in warehouses, may enjoy a clear competitive advantage, as they face lower risk to consumers, employees, and their overall operations. Increasing focus on improving health, paired with increased demand for fresh food could drive longer-term habits focused on healthy lifestyle and nutrition.

Shift to value for money. As in any economic downturn, a postcrisis downturn will probably lead consumers to demand value for money across retail sectors. This is already happening in essential categories, as private-label sales at grocers and pharmacies are increasing, and pricing and promotion strategies are emphasizing value. In the AF&L sector, recent analysis indicates bifurcation of the market with respect to price positioning.

Flexibility of labor.The COVID-19 crisis underscores the need for more flexible resource allocation that deploys labor across a broader range of activities. This could accelerate the move toward more agile and dynamic resourcing from stores to distribution centers to corporate offices. It could drive new models of collaboration between retailers and their stakeholders to address scarce capabilities and enable the labor pool to move more fluidly in order to meet demand across priority activities.

Loyalty shock. Scarcity of products has spurred trial of new brands, as customers trade up and down. In Asia and the United States, but less so in Europe, we have seen store and brand switching due to proximity, availability, ease of use, and safety considerations, creating opportunities for new habit creation. In the United States in particular, many consumers stated they have tried store or generic brands for the first time, with many saying they were satisfied with the product and would purchase again.

As news of COVID-19 spread and as it was officially declared a pandemic by the World Health Organization, people responded by stocking up. They bought out medical supplies like hand sanitizer and masks and household essentials like toilet paper and bread. Soon, both brick-and-mortar and online stores were struggling to keep up with demand, and price gouging for supplies became rampant.

Humans respond to crises in different ways. When faced with an uncertain, risky situation over which we have no control, we tend to try whatever we can to feel like we have some control.

Paul Marsden, a consumer psychologist at the University of the Arts London was quoted by CNBC as saying: “Panic buying can be understood as playing to our three fundamental psychology needs.” These needs are autonomy (or the need to feel in control of your actions), relatedness (the need to feel that we are doing something to benefit our families), and competence (the need to feel like smart shoppers making the correct choice).

These psychological factors are the same reasons “retail therapy” is a response to many different types of personal crises; however, during a pandemic there are added layers.

One is that the global spread of COVID-19 has been accompanied by a lot of uncertainty and at times contradictory information. When people are hearing differing advice from multiple sources, they have a greater instinct to over-, rather than under-, prepare.

Secondly, there is the crowd mentality. Seeing other people buying up the shelves and then seeing a scarcity of necessary products validates the decision to stock up. No one wants to be left behind without any resources.

COVID-19 is Changing the Ecommerce Landscape.

Retail businesses around the world over are being affected by COVID-19 through everything from rapidly changing customer behavior to supply issues.

We’re offering a snapshot of the data around these changes and how businesses are adapting to them.

Fast-forward trend 3: Rising competitive intensity

China’s leading companies retain an outsize share of profits and return on investment, but cut-throat competition threatens their position. COVID-19 will raise competitive intensity, creating even bigger rewards, and risks, for companies in China.

In China, the top decile of companies capture about 90 percent of total economic profit, while the ratio is about 70 percent for the rest of the world, according to our analysis of the world’s top 5,000 companies. This leading cohort is comprised of companies that have already digitized and possess highly agile operations, strengths that served them well during the epidemic. For example, Alibaba’s Freshippo supermarkets surmounted supply constraints and met soaring online orders for fruit. Foxconn’s agility allowed it to switch factory operations to mask production, protecting employees, and enabling resumption of production earlier than competitors. Popular short-video platform TikTok announced it was hiring 10,000 new employees when the virus hit a peak. At the other end of the spectrum, weaker companies, particularly SMEs that are not sufficiently agile or digital savvy, are vulnerable to cashflow issues, unemployment, and business failure.

Next steps for retailers

COVID-19 and the onset of an economic slowdown may well reshape the landscape of retail deals and partnerships. We encourage retailers to take four steps now as they contemplate M&A and partnerships going forward, grounded in the three C’s of excellent M&A strategists (competitive advantage, capacity, and conviction).

Define the next normal—and your competitive advantage. The first step to redefining M&A and partnership strategy is to understand what the next normal means for each brand and retailer. The new reality will depend largely on how core consumer segments, including behaviors and spending habits, have been impacted by COVID-19. Where are the growth spaces today and where will they be in the future? Where are consumers spending money—which categories and/or channels? How have their tastes, preferences, or concerns changed, driving new opportunities for differentiation or shaping new habits? In this context, how have previous competitive advantages changed and what new advantages have emerged? Identifying the opportunities for growth in the next normal—and which areas can be accelerated via partnerships and M&A—will be the first step to reshaping M&A strategy.

Assess capacity to execute acquisitions and partnerships. A realistic assessment of balance-sheet strength and ability to make acquisitions independently (that is, while debt markets are slowed or frozen), as well as ability to secure financing in the postcrisis environment, will be a key input to evolving M&A strategy. Understanding what targets (and what size targets) are feasible to acquire now versus later should inform how areas of exploration are prioritized. For players with limited cash availability or challenging financial health, partnerships with other players to pool financial resources while addressing strategic priorities could be considered (for example, sourcing collaborations).

Build conviction through identification of key areas of exploration within the M&A and partnership market and think through value creation up front. Retailers should generate data-backed perspectives about market trajectory, new-normal scenarios postcrisis, and the risks of further disruption. Shortlisting top-priority areas and securing executive and board commitment to M&A will accelerate decision making as markets thaw and potential targets are discovered. In the post-COVID-19 tight credit market, we expect that synergy capture expectations, and track record, will matter to investors, which makes it even more important to think through synergy ambitions and value-capture plans up front. We also envision that a potential economic crisis will make it more important to carefully think through how a deal can help to sharpen and/or reposition the joint entity’s value proposition(s) to better service customers’ needs.

Explore opportunities to strike new deals and partner with healthier players. Players without the cash and financial health to pursue acquisitions should identify potential assets to liquidate or potential partnerships to shore up the balance sheet until the crisis passes. The implications of COVID-19 are just as high for potential sellers as they are for potential acquirers.

The retail sector cannot escape the economic impact of COVID-19. But, despite the difficult economic outlook, we expect retail M&A activity to accelerate as the crisis stabilizes, creating opportunities for financially sound players to acquire or partner with less advantaged players. Now is the time for retailers to think about M&A postcrisis. This calls for defining their role in the next normal, reevaluating financial health, segmenting the M&A market, and contemplating new deals and partnerships.

Emergency Department Visits

These charts show people who visited the emergency department with clinical

signs and

symptoms consistent with COVID-19 illness (including flu-like illnesses and

pneumonia) during the past three months, and those who were then admitted to the

hospital. While some of these people did not have a positive molecular or

antigen test, these charts can be an

early warning sign for community

transmission of COVID-19.

Visits

Admissions

About the Data: All of the data on these

pages were collected by the NYC Health Department. Data

will

be updated daily but are preliminary and subject to change.

Reporting Lag: Our data are published with a

three-day

lag, meaning that the most recent

data in today’s update are from three days before.

This lag is due to the standard delays (up to several days) in reporting to

the

Health Department a new test,

case,

hospitalization or death. Given the delay, our counts of what has happened

in

the most recent few days are

artificially

small. We delay publishing these data until more reports have come in and

the

data are more complete.

Health Inequities in Data: Differences in health outcomes

among

racial and ethnic groups are due to long-term structural racism, not

biological

or personal traits.

Structural racism — centuries of racist policies and discriminatory

practices across institutions, including government agencies, and society

— prevents communities of color from accessing vital resources (such

as

health care, housing and food) and opportunities (such as employment and

education), and negatively affects overall health and well-being. The

disproportionate impact of COVID-19 on New Yorkers of color highlights how

these

inequities negatively influence health outcomes.

Review

how we are working to address inequities during this public health

emergency (PDF).